On Saturday, February 1, 2025, Finance Minister Nirmala Sitharaman unveiled the budget for the eighth straight year. Next week, the administration will present a new income tax measure that will advance the “trust first, scrutinize later” concept.

The FM highlighted the government’s goal to “unlock India’s potential under the leadership of PM Modi” and stated that this budget carries on with its efforts to boost growth.

According to Sitharaman, the Modi government views the upcoming five years as a special chance to implement Sabka Vikas and replicate growth in every region.

According to the Finance Minister, the Budget aims for “transformative” reforms in six areas including taxation, financial sector, energy sector, urban development, mining and regulatory reforms. These areas remain at the core of the government’s agenda with an aim to boost economic growth, improve infrastructure, improve governance and foster sustainable development across multiple sectors.

“Together, we aim to unlock India’s potential under the visionary leadership of Prime Minister Modi,” said the Finance Minister as she began her address. “This budget is dedicated to accelerating growth, driven by our aspirations for a ‘Viksit Bharat.’ Our economy remains the fastest growing among all major economies. The Budget 2025-26 continues our government’s efforts to secure inclusive development, uplift household sentiment and enhance the power of India’s middle class,” she added.

Let’s Take a Look at the Key Announcements and Highlights of the 2025 Budget:

- Gareeb, youth, nari can be the important thing focus

- Underemployment in agri can be addressed, 1.7 crore farmers will gain

- National Mission on high yielding seeds can be released

- FM proposes 5-year programme for growing Cotton Productivity

- India Post to become massive public logistic business enterprise

- Atal Tinkering Labs: 50,000 such labs to be installation in government faculties in five years

- 10,000 extra seats to be inculcated in clinical institutes; 75,000 medical seats in five years can be created

- Kisan Credit Cards for 7.7 crore farmers; mortgage Limit improved to ₹five lakh

- MSME: Term loans up to ₹20 crore can be given

- Modified UDAN scheme to be released; 120 new locations below changed UDAN scheme

- SWAMIH Fund: any other 40,000 housing devices to be finished in 2025

- Top 50 tourism destination to be developed

- National Geospatial Mission introduced

- Second Gene Bank to be installation for destiny meals protection

- Greenfield airports to be facilitated in Bihar

- New income tax bill next week, says Sitharaman

- Jan Vishwas Bill 2.0 to be introduced in to decriminalise a hundred provisions

- Revised financial deficit predicted to be 4.8% of GDP

- Capital expenditure at ₹10.18 lakh crore

- Gross marketplace borrowings at ₹14.82 lakh crore

- Social welfare surcharge on 82 tariff lines waived

- 36 life-saving drugs completely exempted from customs duty

- Handicrafts: 9 objects to be introduced to duty free inputs

- Personal tax reforms with unique focus on middle class

- TCS for remittance on education purposes removed

- Compliance burden decreased for small charitable trusts

- New scheme to decide Arms period Price in global transactions to be added

- Digitalization being operationalized in tax frameworks

- Start ups: Extending incorporation advantages for 5 years

Direct and indirect taxes

- Income tax reforms with special focus on the middle class

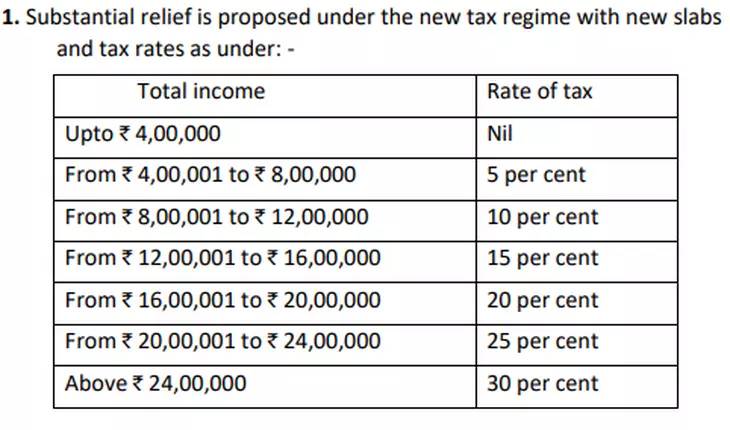

- The new tax system provides significant relief including:

- Zero rate has been increased to 12 Lakhs – Rebate

- Rebate for resident individuals under the new regime – No tax on total income up to 1.2 Lakhs.

- Capital gains limit has been increased to ₹ 12.7 Lakhs.

- The deadline for filing updated tax returns has been extended from the current 24 months to 48 months after the end of each tax year.

- Information obligation on crypto assets

- Annual valuation of owner-occupied property has been simplified.

- ACC Women’s Basketball Tournament 2025: Full Schedule, Bracket & How to Watch - March 5, 2025

- LeBron James Becomes First NBA Player to Score 50,000 Points - March 5, 2025

- Google Messages Rolls Out AI-Powered Scam Text Detection - March 5, 2025